Kansas City, MO – American travelers aren’t cutting back – they’re getting selective. According to new data from MMGY, U.S. travelers are maintaining steady travel plans despite rising costs and are gravitating toward hands-on culinary experiences and choosing intimate family vacations over traditional holiday gatherings. The message is clear: Travelers want experiences that feel authentic, interactive and deeply personal.

Based on a survey of more than 4,500 U.S. travelers, Portrait of American Travelers™ is the travel industry’s longest-running and most-trusted examination of leisure travel behavior in America. The report’s “Fall Edition” found that short-term travel intentions remain stable at 66% for the next six months, demonstrating the resilience of travel as a consumer priority. And while tariff impacts have stabilized and travel intentions remain relatively steady, the research reveals a significant shift toward value-conscious decision-making and experience-driven travel.

American travelers remain eager to explore, but they’re making different choices about how and with whom they travel. Specifically, we’re seeing a meaningful shift in holiday travel priorities. While visiting friends and family remains the most common choice, a growing number of travelers are opting for leisure vacations with their immediate families, prioritizing memory-making and deeper connections with their closest circles over traditional gatherings. Simon Moriarty, Vice President of Syndicated Research for MMGY Travel Intelligence

Key takeaways from the report include:

- Holidays Get More Intimate – Over half (53%) of active leisure travelers plan to travel for the winter holidays, but traditional patterns are evolving. While visiting friends and family remains the most common arrangement (45%), a growing share are choosing leisure vacations with their immediate families (36%) instead. The trend signals that travelers increasingly prioritize creating shared experiences and deeper connections with their closest circle over making the traditional rounds to visit extended family.

- Culinary Travel Gets Hands-On – Travelers are trading white tablecloths for cooking aprons. Interest in cooking classes jumped to 19% (up from 15% in 2024), while demand for award-winning restaurants dropped 13 percentage points to just 18%. This shift signals that travelers increasingly value interactive, local food experiences over prestige dining, a sentiment driven partly by rising costs and a greater focus on value-for-money experiences.

- World Cup Creates Opportunity – Soccer fans and travel marketers alike are counting down the days until the 2026 FIFA World Cup. In fact, 21% of active leisure travelers plan to travel specifically for the event, and they are willing to spend an average of $3,652 per trip. Experiencing a once-in-a-lifetime event and supporting their national team are both cited as top motivations by 37% of respondents.

- AI Adoption Accelerates – Forty percent of active leisure travelers have used ChatGPT or other AI tools for travel planning – a 10 percentage point increase from this time last year. Millennials and individuals with children lead adoption (both at 59%), primarily using AI to discover activities of interest. However, human expertise still reigns supreme: Travelers trust recommendations from human experts more than twice as much as AI-generated suggestions.

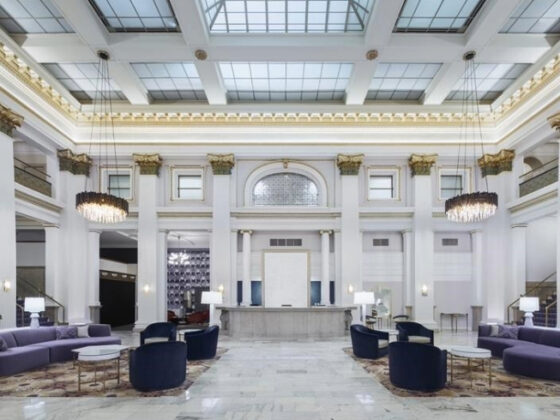

Featuring these insights along with in-depth data on international travel, vacation motivators and destination preferences, the “Fall Edition” of Portrait of American Travelers™ is now available for purchase or as part of an all-access subscription to EurekA!, MMGY’s searchable research platform. To learn more, visit mmgyintel.com.

About the 2025Portrait of American Travelers™

MMGY’s Portrait of American Travelers™ is the travel industry’s longest-running and most-trusted examination of U.S. leisure travel behavior. It provides a comprehensive analysis of the impact of current economic conditions, social values, and emerging travel habits and intentions. The “Fall Edition” is based on interviews with 4,503 U.S. adults conducted in July 2025, with generational insights from Gen Zers (18–28), Millennials (29–44), Gen Xers (45–60) and Boomers (61–79). Results from the Silent Generation (80+) are included in totals but not reported separately due to sample size. This is the third of four quarterly reports slated for 2025.

About MMGY Global

MMGY Global is the world’s leading integrated marketing firm specializing in the travel, hospitality and lifestyle industries. With operating brands across the world, the award-winning organization maintains a global communications practice in all marketing channels, serving many of the world’s premier travel and tourism brands. As a company dedicated to the travel industry, MMGY Global strives to create a connected, inclusive and peaceful world by promoting travel as a cultural bridge of understanding. For more information, visit mmgyglobal.com.

Derek Klaus

MMGY Global

MMGY Global