With another strong, profitable year under their belts, airlines are ready to return to “normal.” According to Phocuswright’s latest travel research report U.S. Airline Market Report 2023-2027,

they are already seeing travel patterns that mirror pre-pandemic times, leading them to believe that trends have shifted back to 2019 and before.

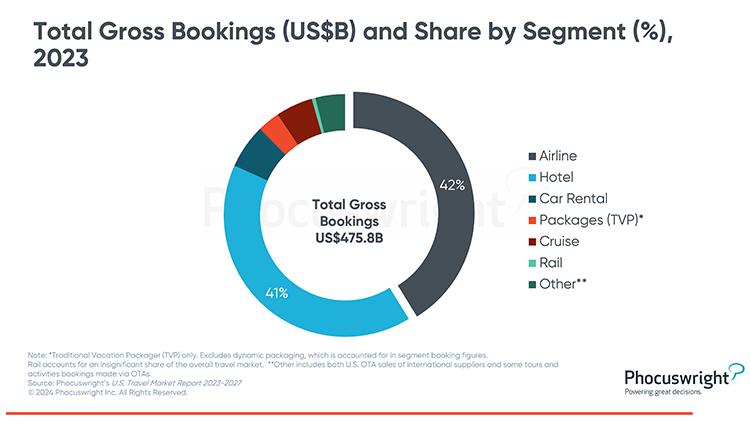

In 2023, the air segment represented 42% of U.S. travel bookings (see figure below), edging out hotels as the country’s largest travel segment. But the drawn-out comeback in corporate travel, a slowdown in economic growth and nagging worries about a possible recession in the latter part of 2024 will keep airlines guarded about the year ahead. Due to increases in capacity and lower overall airfares, airlines will not see the remarkable double-digit growth of the past three years going forward. If anything, 2024 will be a year of cautious optimism as carriers look to stay nimble and reactive in an unstable environment.

Looking ahead, there are five key areas where airlines will focus their energy:

- A (small) business travel rebound

- Optimization is key

- Airlines get serious about NDC

- Low-Cost carriers struggle

- Outlook: Avoiding recession, again

For an in-depth analysis of these five areas, as well as detailed analysis into the size of the U.S. air market and the distribution landscape, get the full report here.

This report is part of the U.S. Travel Market Report 2023-2027 series, which features an overview of the U.S. travel market, along with detailed data and analysis of five key segments: airline, hotel & lodging, car rental, cruise and packaged travel.

A standalone report dedicated to online travel agencies rounds out the coverage. Collectively, the series provides comprehensive market sizing, projections and analysis for the U.S. travel industry from 2021-2027.

Other reports in the U.S. Travel Market Report 2023-2027 series include: (available now or publishing soon):

Research is our priority. Our Open Access research subscription puts the world’s most comprehensive library of travel research and data visualization at your fingertips.

Clients have relied on Phocuswright’s deep industry knowledge for over 25 years to power great decisions, help justify a pitch, build a strategic plan and elevate any presentation through trusted research and data. When companies and executives reference

Phocuswright, they gain the trust of an industry keen on data, trends and analytics.

See the full benefits of an Open Access subscription here.

Plus, we just redesigned Phocal Point, the powerful data visualization tool that now makes it easier to access and interpret Phocuswright data.

It’s all about the data. With an updated navigation interface, new dynamic filtering, additional segment and channel breakouts in select markets and rich detailed views of 35+ markets, Phocal Point allows you to create custom interactive charts and view

travel data by segment, channel, device, region and country. Our proprietary travel industry market sizing data allows you to look to the future with projections through 2026, and review historical data as far back as 2009.