The U.S. hotel industry saw 800 transactions in the first quarter of 2024, according to data from CoStar. Higher interest rates continue to take a toll on transactions, with the estimated undisclosed dollar volume at roughly $4 billion—the lowest for a first quarter since 2010. When looking at disclosed dollar volume, transactions were at $3.4 billion.

made up 20 percent of the quarterly transaction activity. The most notable deal was the sale of two thirds of the ownership of the 423-room Ritz-Carlton Key Biscayne, Miami, from Brookfield Hotel Properties to Gencom. That deal closed at $400 million (the highest sale price for Q1 2024) and $1.43 million per key (the highest price per key for Q1 2024).

Other notable sales included the Wyndham Boston Beacon Hill to RLJ Lodging Trust, which represented the entire Q1 sales volume in the market (second highest by sales price at $125 million), and the AC Hotel Washington DC Convention Center for $116.8 million to Apple REIT, which represented 70 percent of Q1 transaction activity in the market. That deal included FF&E valued at nearly $10 million and was the third-highest sale in the United States during the quarter.

New York City, which ranked second in Q1 hotel sales volume, saw eight hotel deals close, generating $236 million. The East River-Queens/Brooklyn West area had the highest sales volume in the market, with three hotel sales accounting for a combined $94 million. One of the three was the Trademark Collection by Wyndham Brooklyn, which was traded in a bankruptcy auction for $34.9 million.

Atlanta (13 transactions) and Denver (10 transactions) were the only markets to see double-digit transactions. Of the $102 million transaction volume in Atlanta, 70 percent came from eight Marriott and Hilton middle-tier class hotels, with sale prices ranging from $15 million-$21 million. Denver followed a similar trend, with 66 percent of the $82 million in Q1 volume from four middle-tier hotels.

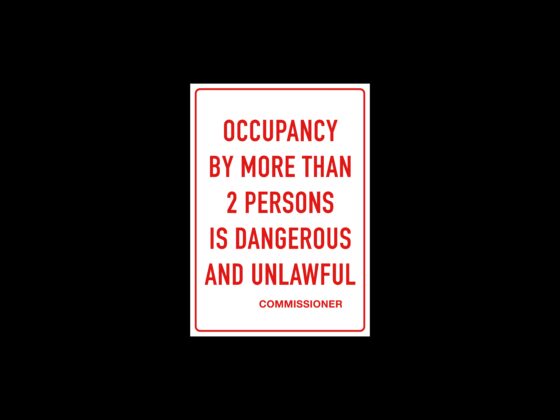

In Los Angeles, hotel transaction volume has declined nearly 75 percent. Since April 2023, when the “Mansion Tax” took effect, only four hotels have traded in the market with price points above $20 million, two of which were tax exempt. In addition, higher interest rates, hotel union labor strikes, and legislation impacting Los Angeles hotel values have dampened high-priced transaction activity.

During Q1, the sale of the 176-room Residence Inn Los Angeles LAX Manhattan Beach for $68 million represented over 80 percent of first-quarter sales volume in the market. The 12-month average hotel occupancy for the Los Angeles Airport area is near 80 percent, making this the second-highest occupancy destination in the state.

Excluding the Ritz-Carlton Key Biscayne, Miami, most of the highest price-per-key transactions were small hotels in the lower and middle-class tiers within high-leisure destinations. Future uses and transaction types were across the board, with some hotels being slated for conversion or investment purchases. These deals consisted of mostly private buyers and REITs.

Despite a slow start to 2024, brokers, lenders, and owners have expressed their decidedly optimistic outlook for the remainder of the year.