It’s a battle of room additions—by any means necessary.

As lodging companies readily transfer their ownership and management duties to embracing a fee-based model focused on franchising, one thing matters most: multiplication. Put simply, adding more rooms in the shortest amount of time and, thusly, being rewarded by Wall Street.

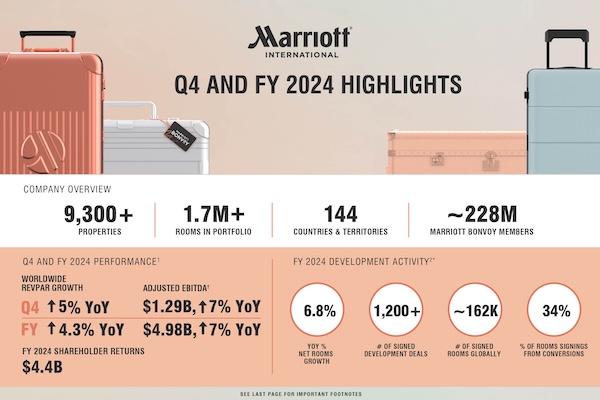

Marriott International showed off in 2024, adding 123,000 rooms—bringing its global room count to more than 1.7 million rooms—and producing net unit growth of 6.8%. At the end of the year, Marriott’s worldwide development pipeline totaled nearly 3,800 properties and more than 577,000 rooms. By contrast, Hilton said it added just shy of 100,000 rooms in 2024 (a record) and produced net unit growth of 7.3%. Its development pipeline stood at 498,600 rooms.

It turns out, the absolute number of rooms is more of a trophy status. Analysts and investors are more focused on the growth rate percentage, with Hilton eclipsing Marriott’s growth rate by 5 percentage points.

Often in this higher-interest-rate environment, more room additions mean more property conversions, as new development remains stunted, something Tony Capuano, president and CEO of Marriott International, noted on his company’s fourth-quarter and full-year 2024 earnings call. “Conversions were again a large driver of growth in 2024, contributing to about a third of our signings and over half of our openings,” he said, citing the addition of around 38,000 rooms from its agreement with MGM and approximately 9,000 rooms from Sonder.

As Michael Bellisario, managing director and senior research analyst for hotels, global brands and real estate at Baird Equity Research, pointed out, more rooms do not necessarily mean more fees, “which is what the public market values,” Bellisario said. For example, Marriott, in its MGM partnership, is only paid on rooms booked directly through its own channels. Hilton added some 5,800 rooms through its deal with Graduate Hotels and more than 19,000 strategic partner rooms through other deals with such entities as AutoCamp and SLH.

Though new construction isn’t as robust, Capuano argued that it’s not about the viability of the projects, but rather some uncertainty in the lender community. “The irony is that when we talk to lenders, often, the hospitality loans in their commercial real estate portfolios are the best performing,” he said. “If they have reluctance to lend on new construction, it has little to do with the fundamentals, and much more to do with the unknown,” citing things like Basel III (a set of international banking regulations that establish minimum requirements for banks’ capital, liquidity and risk management) and other regulatory requirements that could be imposed.

Performance Art

Global RevPAR at Marriott rose over 4.3% for the year, with the U.S. and Canada seeing its best quarterly RevPAR growth of the year in Q4, rising over 4% and driven primarily driven by higher ADRs. Capuano also noted that the drop in occupancy around November’s U.S. election was not as severe as it had anticipated, with demand rebounding quickly.

International RevPAR growth was also strong, rising 7% in the quarter, with heavy gains in Japan, India and Thailand. China remains the outlier: RevPAR in Greater China declined 2%, though Capuano allowed that the decrease was “better than prior expectations,” as the region benefited from the recent expanded visa-free-transit policy.

By customer segment, leisure, at 44%, comprises the largest portion of Marriott’s global room nights and had its strongest RevPAR-growing quarter of the year, rising 6% and 4% in the U.S. and Canada, respectively. Solid gains in ADR drove business transient RevPAR up 3% globally and up 4% in the U.S. and Canada. Group RevPAR, which comprised 23% of room nights, rose 3% in the quarter, in line with Marriott expectations. It was group’s lowest growth quarter of the year, due to fewer group events in the U.S. around November’s election and a decline in Group RevPAR in Greater China.

Business travel has returned closer to 2019 levels but the composition is different, noted Leeny Oberg, CFO and EVP of development of Marriott International. While small-and-medium-sized businesses came back faster out of the gate than the largest corporates, Oberg now said that large corporates, especially in the financing sector of the economy, are back to more than recovered.

Art of the Deal

In December, Marriott announced plans to launch an outdoor-focused collection, following its deals with Postcard Cabins and Trailborn. “Our focus on offering fantastic travel experiences for every trip purpose is key to ensuring that Marriott Bonvoy remains the industry leading travel platform,” Capuano said, noting that Marriott added more than 31 million new members in 2024 to the loyalty program, which now stands at around 228 million members.

More deals could come to build out the Marriott travel platform, but Capuano was quick to say that the vast majority of rooms growth will be through organic growth. “When we have identified a gap—either in our brand portfolio or in our geographic footprint—that we thought could be more effectively filled through a tuck-in acquisition, we’ve done that in some instances,” he said. “We’ll continue to look at both the breadth of the brand portfolio and our expanding global footprint, and if we think there’s an opportunity to fill those gaps, we will certainly consider a tuck-in acquisition.”

Spending Wisely

Beyond the money Marriott is bringing in, there are three main concurrent buckets of expenditure, as Oberg outlined. It’s biggest is a multiyear technology rehaul of its PMS and loyalty systems, which Oberg said would be reimbursed over time. “Elements of the tech transformation will start to roll out later this year,” Capuano said, adding that reconstituted tech platforms will not only benefit customers but help employees do their jobs far easier. “There are far-reaching impacts to this transformation, starting with Marriott associates, with the simplicity and the streamlined training that we think will be a big advantage as we go out and try to attract best-in-class talent,” he said, adding that for owners there are advantages on both the revenue and expense side. “We expect there to be enhanced efficiency.”

The second bucket is spending for its own lease portfolio, which is expected to be above historical levels in 2025 with about half of the expected investment driven by the completion of renovations on the Elegant Hotels portfolio in Barbados, a portfolio that Oberg said Marriott expects to sell once the renovations are completed, subject to long-term contracts to remain in the Marriott system. The last bucket is expected investment in contracts, largely for new units “as we continue to expand our global portfolio,” Oberg said.

Late last year, Marriott announced an initiative “to enhance effectiveness and efficiency” across the company with expected resultant savings of $80 million to $90 million annually beginning in 2025. It meant the layoffs of more than 800 corporate employees at its Bethesda, Md., headquarters as part of a company-wide restructuring. The layoffs were effective January 3, 2025. Asked if the restructuring had yet reaped any benefits, Capuano said there is energy across the enterprise “about how streamlined our decision-making will be as a result of this, particularly in the field.”

Marriott said it will also continue to use its balance sheet to hunt and secure deals by dangling key money, which it uses on about a third of all deals. “We’ve got lots of financial tools in our toolbox for those deals that we think will provide outsized volumes of fees,” said Capuano. “The competitive landscape has really shifted toward key money being the tool of reference. As we look at trends, we are seeing a bit more key money required across more tiers, meaning we’re seeing it used in lower chain scales, which is a bit of a new development.” Capuano added that they are deploying slightly less key money per deal.