The presentation of Accor’s financial results by Sébastien Bazin and Martine Gerow confirms, if proof were needed, that the group has elevated its performance level, notably thanks to its Luxury & Lifestyle division, which continues to achieve double-digit growth.

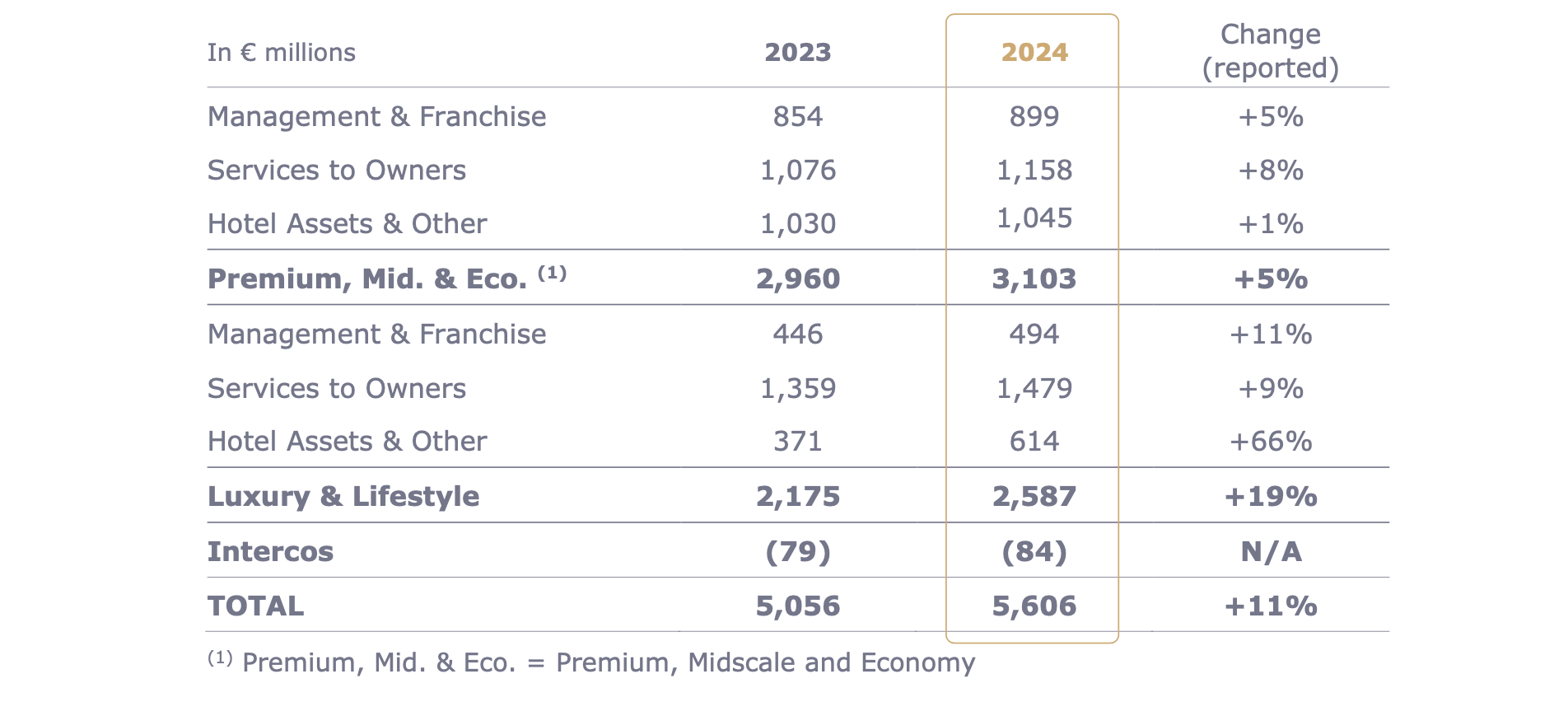

In comparing revenue growth between the two divisions, it is worth noting that while Premium Midscale Economy division still leads in volume, the gap with Luxe & Lifestyle is narrowing year after year, given the acceleration of high-end development.

The Luxe & Lifestyle division is accelerating its pace

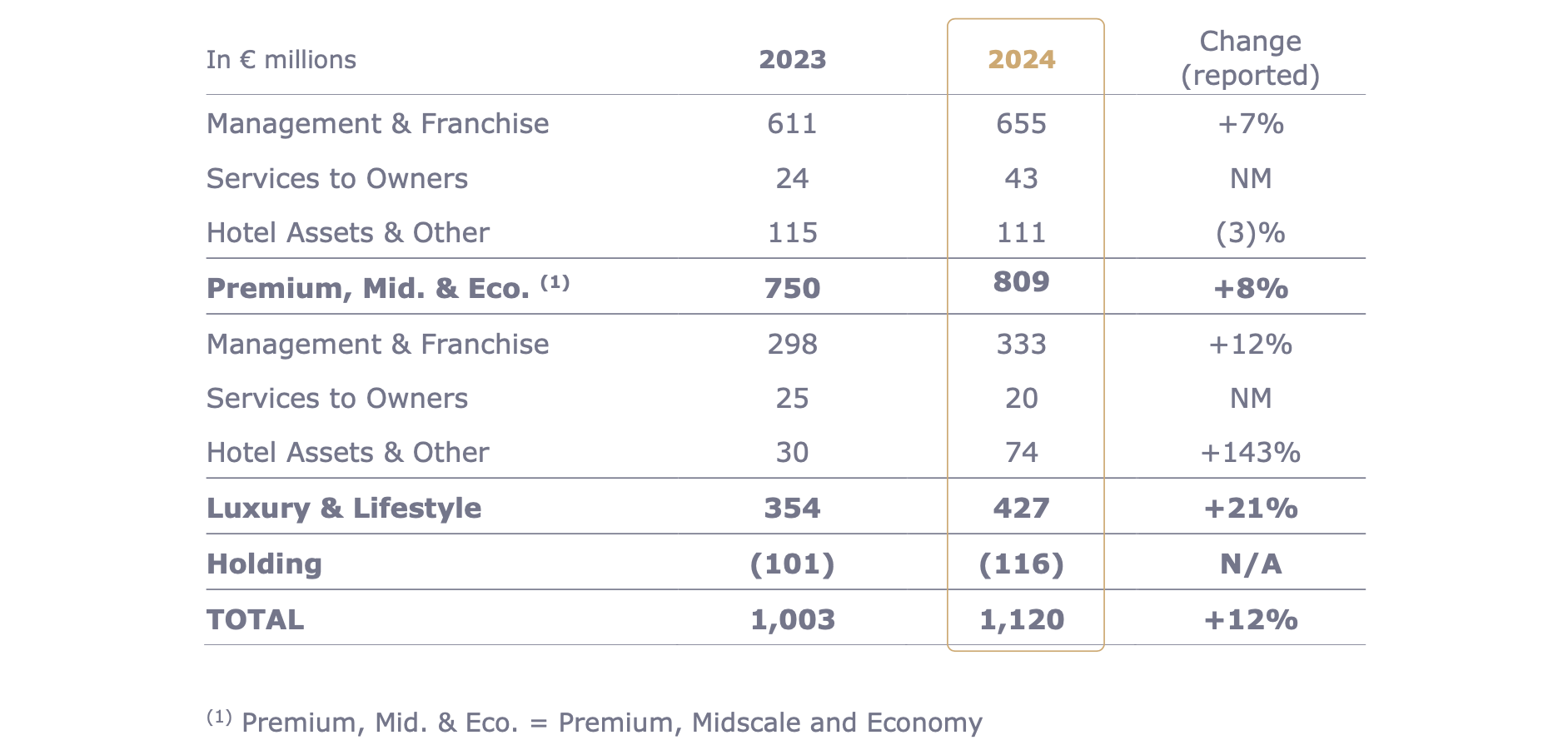

The group’s gross operating profit (EBE) reached €1.12 billion in 2024, a new record for Accor and a 12% increase compared to 2023. This performance is far from the approximately €500 million achieved before COVID, which was already considered strong.

The global RevPAR is boosted by both its indicators

The good news is that RevPAR remains solid across both indicators—occupancy growth and, more importantly, average rates. The hotel portfolio continues to expand, with around 280 openings in 2024. Margins are improving on management and franchise contracts, owners are increasingly utilizing available services, particularly in marketing and distribution, and cost control has further strengthened.

While the Luxury & Lifestyle division generated a current EBE of €427 million, up 21% from 2023, the PME division contributed €809 million, highlighting its essential role within the group, though its growth was only 8% compared to 2023.

The group stands firmly on two legs, one still larger than the other, given its historical structure, but it remains determined to bridge the gap as the Luxury & Lifestyle division rapidly catches up. Given its current pace, it is easier to understand Sébastien Bazin’s personal investment in this division.

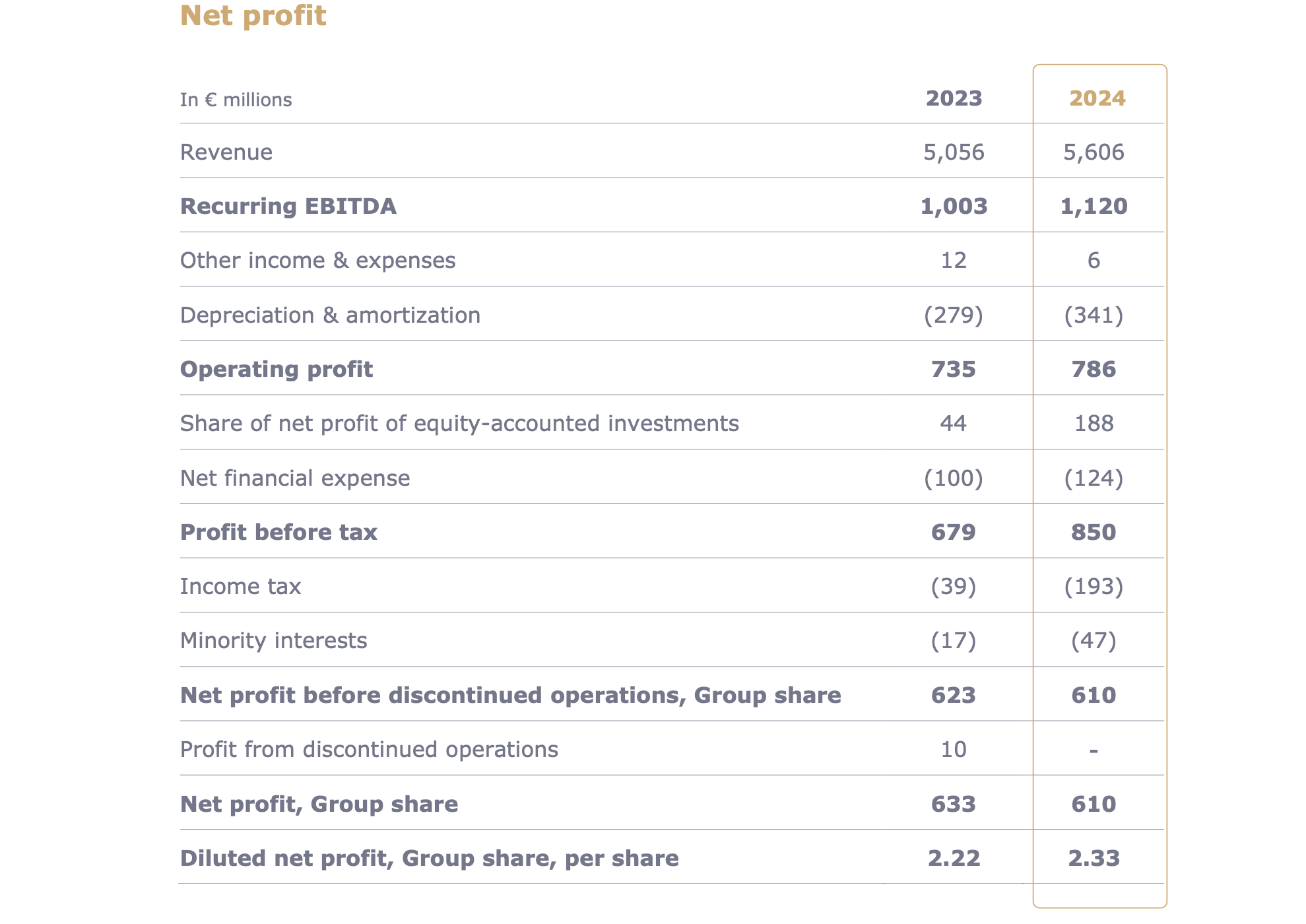

The group’s net profit reached €610 million for the 2024 fiscal year, compared to €633 million in 2023, impacted by a significant rise in depreciation and deferred tax increases from previous fiscal years.

The chairman emphasized that the results aligned with previous announcements made during the Capital Market Day, ensuring that financial markets were not disappointed. These results were achieved “at all costs,” thanks to the dedication of teams at all levels. He particularly urged the financial community to focus on the right indicators.

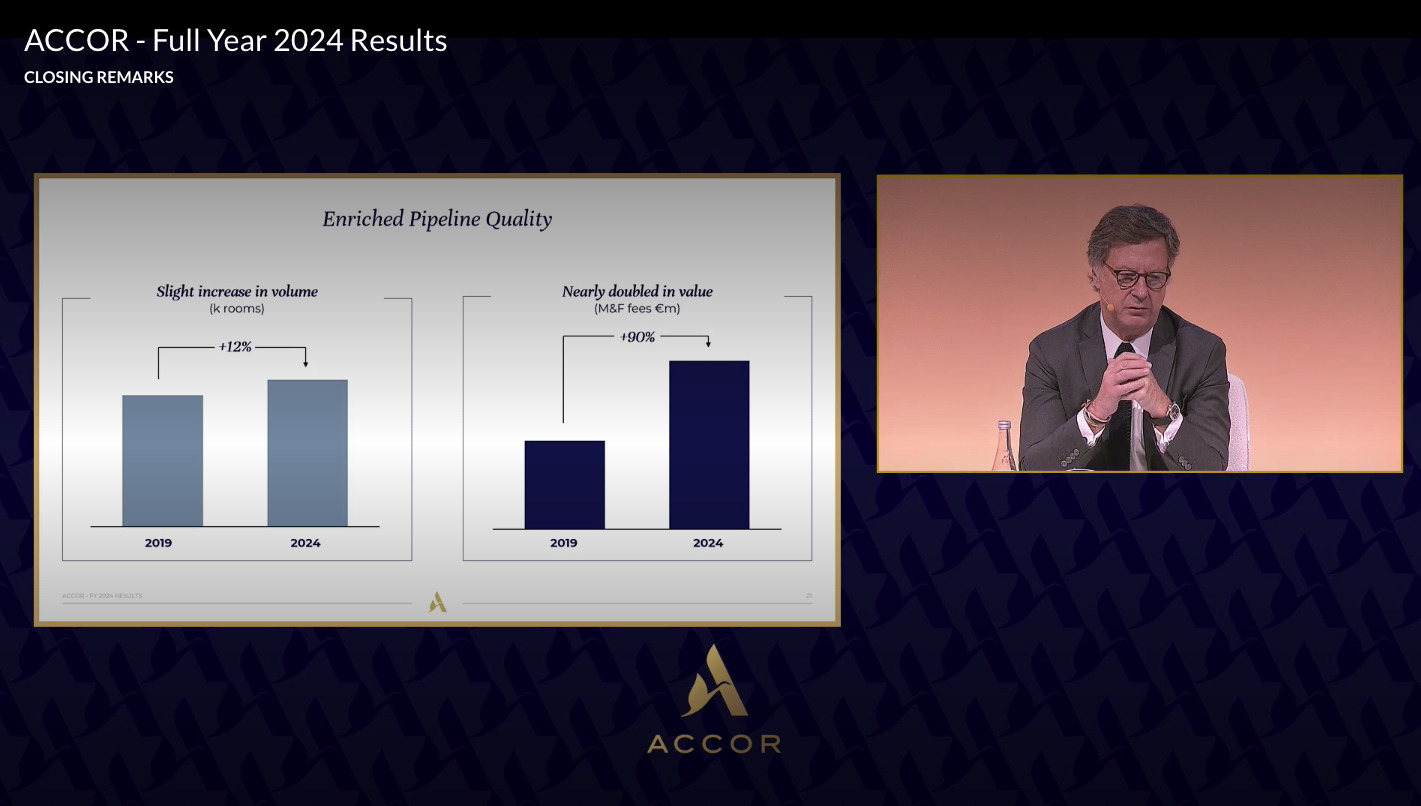

The intensive quest for added value over volume

Still focused on the group’s growth and the continuous addition of new rooms, the market often overlooks the only metric that truly demonstrates growth performance: over the past five years, each new room has generated a higher royalty rate, which has increased by 90% in value, while the portfolio’s volume growth was only 12%. “I am committed to ensuring this 90% increase is more than doubled in the coming fiscal years,” Bazin concluded.