This page serves as a comprehensive aggregation of the latest news and updates about Airbnb, curated from all our trusted and reputable sources. By consolidating information from industry-leading publications, official announcements, and expert analyses, we aim to provide our readers with a reliable and up-to-date overview of developments related to Airbnb. Our goal is to ensure that visitors receive accurate, timely, and relevant insights into the company’s activities, innovations, and market trends through a carefully curated collection of news from authoritative sources.

-

Did Google Just Make Travel Platforms Redundant?

🗺️ Google has introduced the Universal Commerce Protocol (UCP), potentially disrupting platforms like Airbnb and Booking.com. By early 2026, AI sessions accounted for 18% of global queries, with users spending over 13 minutes per session. UCP enables real-time booking, with current availability limited to U.S. users in Google’s AI Mode and Gemini app. As luxury travelers still value human advisors, UCP serves as an efficiency tool while emphasizing the importance of data hygiene to avoid AI errors.

-

My old reporter's instinct is kicking in, and I have lots of questions about what's going on over at Airbnb for Hotels. It's looking like Airbnb both as a partner and a competitor are going to be… | Jason Freed | 14 comments

🏨 Airbnb is making moves in the hotel industry, aiming to partner with hotel brands to list on Airbnb.com, similar to past strategies by Expedia and Booking. Recently, Airbnb has hired experts in hotel real estate and distribution. They’re expected to have a strong presence at ALIS this month. The potential introduction of Airbnb-branded apartment-style hotels is being considered, amid growing demand for such accommodations. The evolving landscape raises questions about the future of Airbnb’s uniqueness and its blend with…

-

Airbnb's Structural Problem: Hospitality vs Tech | Stuart Greif posted on the topic | LinkedIn

📈 Airbnb’s role is more about resolving issues than hospitality, addressing failures like refunds and cancellations. Sonder, once valued at $2.2 billion, liquidated via Chapter 7 by November 2025. Vacasa, valued at $4.5 billion in 2021, was sold to Casago in April 2025 for $130 million, a 97% decrease. Inspirato’s gross margins fell from 71% to 31%, leading to a $59 million acquisition by Exclusive Resorts. These failures highlight the operational challenges of short-term rentals.

-

Lake.com Partners with OwnerRez to Simplify Vacation Rental Management for Waterfront Hosts

🏖️ January 19, 2026, New York, NY: Lake.com partners with OwnerRez to streamline vacation rental management. OwnerRez, founded in 2009 in Seattle, offers plans from $40/month, enhancing synchronization with platforms like Airbnb. The integration connects Lake.com with OwnerRez’s 100% remote team, expanding visibility to 1,400 lakes and 4,000 parks. Listings sync within 30 seconds, with updates every five minutes. The partnership strengthens property management tools, offering seamless guest experiences via Rezzy AI Assistant and other enhancements.

-

Tripadvisor faces growing competitive and financial pressure

🛰️ Tripadvisor faces challenges with slowing growth as of January 19, 2026. The company reports low single-digit revenue growth and declining bookings, while competitors like Expedia, Booking Holdings, and Airbnb gain market share. Restructuring plans aim to improve margins, but struggle against demand and brand relevance issues. Despite growth in the Viator segment, high cancellation rates and competition limit gains. Diminishing adjusted EBITDA margins further pressure profitability, impacting Tripadvisor’s investment appeal.

-

Airbnb accelerates its push into hotel distribution

🏨 Jan 19, 2026: Airbnb creates a new hotels leadership team to expand its influence in the hotel sector and compete against online travel agencies. Appointing Jesse Stein as head of hotels and hiring Lou Zameryka from Booking.com, alongside ex-Radisson CEO Jim Alderman, strengthens Airbnb’s position. The strategy targets boutique hotels initially, and aims to diversify amidst regulatory pressure on home-sharing. Hotel listings’ integration with home rentals remains undecided, impacting customer perception and conversion.

-

Airbnb has been a total failure as a public company which is what no one has been willing to say aloud! Its stock is negative over the past 5 years while hoteliers Marriott, Hilton, Hyatt, IHG… | Stuart Greif | 19 comments

💸 Airbnb’s stock performance has been disappointing over the past 5 years, lagging behind competitors like Marriott, Hilton, and Booking. While competitors saw growth, Airbnb’s value decreased, raising concerns about its strategy to evolve into an OTA platform. Although the founders are acknowledged for their innovation, the company’s public market success is lacking. This underperformance is especially notable with equity considerations for employees and potential hires. The market’s long-term view could change if Airbnb adapts successfully.

-

Airbnb strengthens hotel and tech leadership team

💻 Ahmad Al-Dahle, former Meta Generative AI lead, becomes Airbnb’s CTO, bringing experience from Meta and 16 years at Apple. Airbnb CEO, Brian Chesky, emphasizes the intersection of technology and the physical world. Jesse Stein steps up as global head of hotels, focusing on partnerships and hotel visibility. Lou Zameryka joins as global head of hotel enterprise and connectivity partnerships, aiming to enhance Airbnb’s hotel distribution.

-

The Deep Dive: Will the UK end the use of asylum hotels by 2029?

📝 By 2029, the UK plans to end using hotels to house asylum seekers. As of September 2025, over 36,000 asylum seekers reside in hotels, with costs projected to reach £15.3 billion over the next decade. Migrant arrivals via small boats reached 41,472 in 2025. The government aims to collaborate with local authorities for alternative accommodations, yet challenges remain due to housing shortages and planning constraints. Hotel reliance reflects deeper systemic issues, questioning the feasibility of the 2029 deadline.

-

Hilton moves into apartments “For the Stay”

🏠 Hilton’s latest venture into apartment-style accommodations, Apartment Collection by Hilton, launches in partnership with Placemakr. Initial U.S. bookings begin in 2026, adding up to 3,000 new units to Hilton’s inventory. This move follows Hilton’s strategy to diversify beyond traditional hotels, similar to competitors like Marriott. The collaboration taps into the growing demand for standardized, flexible stays, allowing Hilton Honors members to earn and use points. Placemakr, established in 2017, enhances credibility and inventory access for Hilton’s 235 million members.

-

LLMs vs. Marketplaces

💸 Marketplaces face challenges from LLMs like ChatGPT, which could disrupt customer acquisition and engagement, especially in sectors with fragmented, heterogeneous supply. Expedia and TripAdvisor may struggle, while DoorDash and Uber are less affected. Key factors include supply aggregation difficulty, marketplace management, transaction frequency, and purchase consideration. E-commerce giants like Amazon hold leverage against LLMs. To remain competitive, marketplaces should enhance AI search, manage supply, and avoid customer experience degradation. High market share offers leverage against LLMs.

-

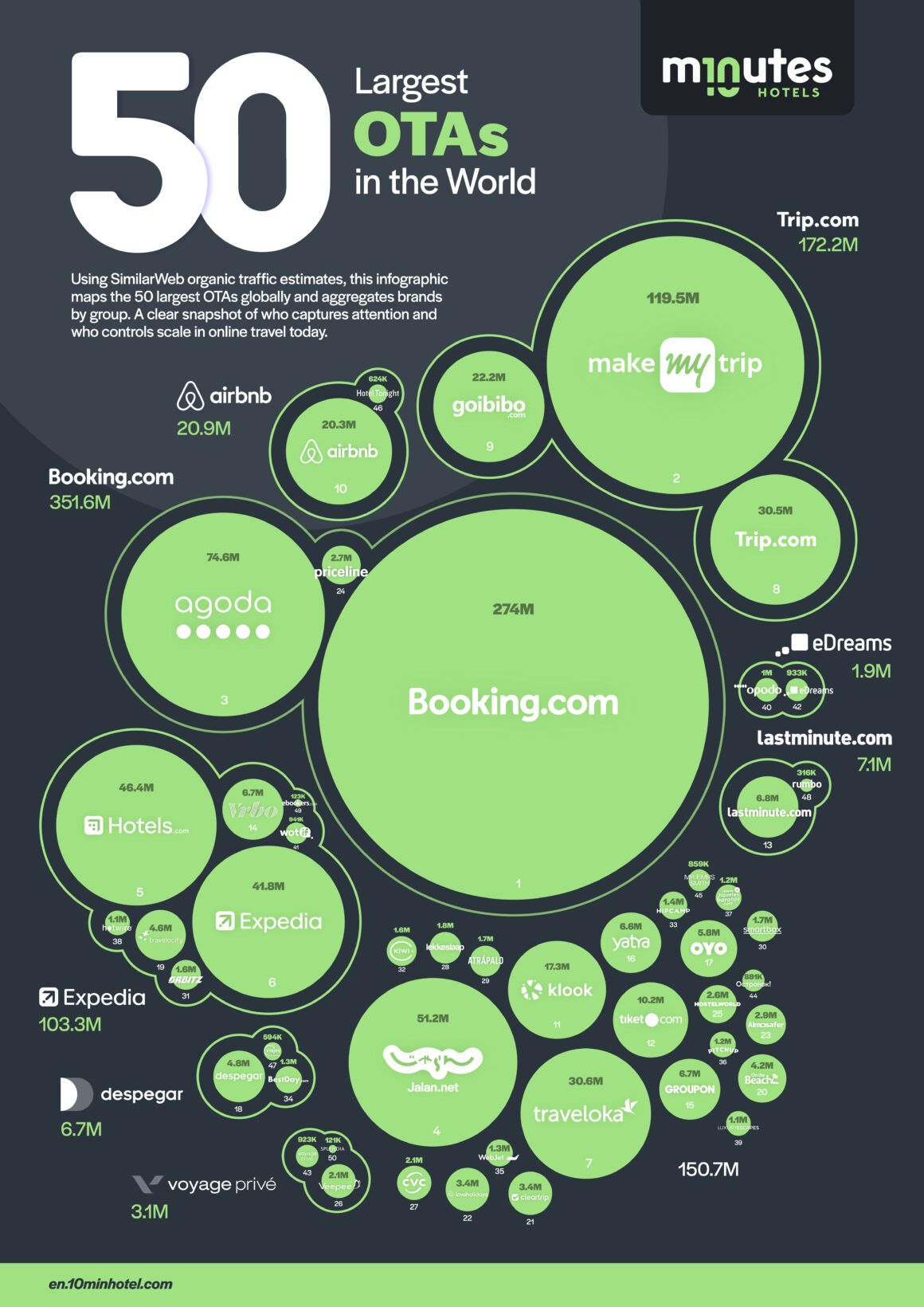

Expedia and Booking is not a duopoly

🌎 Trip.com surpasses Expedia in reach with 172 million compared to Airbnb’s 20 million. Market caps: Airbnb at $84B, Trip.com at $50B. Japan, India, and Latin America have large domestic OTAs. 10 Minutes News offers a global OTA dataset, excluding China, for subscribers. For better hotel distribution strategy, focus on platforms with strong reviews in existing markets, as shown by UK guest feedback compared to Japan’s. Feedback on data improvements is encouraged.

-

Kasa Enters into Strategic Combination with Mint House

📈 Kasa and Mint House have joined forces, integrating nearly 1,000 national units into Kasa’s platform, including the iconic 70 Pine building in Lower Manhattan. This strategic move broadens Kasa’s reach across key U.S. markets—Washington, D.C., Dallas, Nashville, St. Petersburg, and Tampa. With this transaction, Kasa enhances operational efficiency and guest experience, leveraging its history of 35 successful transitions and commitment to high-tech, high-service hospitality. Mint House CEO Christian Lee joins Kasa as a Senior Advisor.

-

I studied 20 travel trend reports for 2026 so you don't have to. ABTA, Amadeus, Expedia Group, Airbnb, Black Tomato, Skift, Skyscanner, Mr & Mrs Smith… the full stack. One pattern kept showing up… | Ari Adnan Cibari | 30 comments

🌎 Travelers in 2026 prioritize experiences over destinations. Set-Jetting, a burgeoning $8 billion trend, sees 81% of Gen Z and Millennials planning trips from what they watch, with Seoul bookings from Japan up 33% due to K-Pop and K-drama. Workshops are up 93%, and sports tourism could hit $2.1 trillion by 2030. Operators should focus on interests, not locations, with keywords shifting to passion-based terms. Solo travelers make up 24% of group bookings, seeking connection over singles trips.

-

Nestor Stay Grows Booking Value 62% and Direct Bookings 168% after Using AI Tools on Apaleo

📈 Nestor Stay, a London hospitality group, boosted Gross Booking Value by 62% and direct booking revenue by 168% in 2025, utilizing AI via Apaleo’s platform. They expanded by 80 units across five buildings, achieving an 8.7 average guest review score. A three-person team handled 84,000 guest messages annually. Key properties achieved 87% occupancy and direct booking increases to 28%. AI automation improved communication, review handling, and booking management, enhancing operational efficiency and performance.

-

Nestor Stay Grows Booking Value 62% and Direct Bookings 168% after Using AI Tools on Apaleo

💻 Nestor Stay, a London-based hospitality group with 14 properties, boosted Gross Booking Value by 62% and direct booking revenue by 168% using AI tools on Apaleo’s platform. In 2025, they expanded by 80 units across five buildings, maintaining an 8.7 average guest review score. The AI managed 84,000 guest messages annually, with a three-person team, and integrated an AI voice agent to improve booking capture. At The Carlyle, occupancy reached 87%, with an ADR of £490.

-

The Complete OTAs of the World List

📰 Booking.com attracts 274 million organic visits monthly, 2.6 times larger than Expedia Group. Trip.com follows with 172 million visits, 1.6 times that of Expedia, but has regional strength. Airbnb sees 20 million visits, 10 times less than Booking.com. The OTA market is notably concentrated, with Booking.com being the only global presence, while others like Trip.com and Expedia have regional dominance. 10 Minutes Hotel provides a dataset to assist hoteliers in optimizing distribution strategy.

-

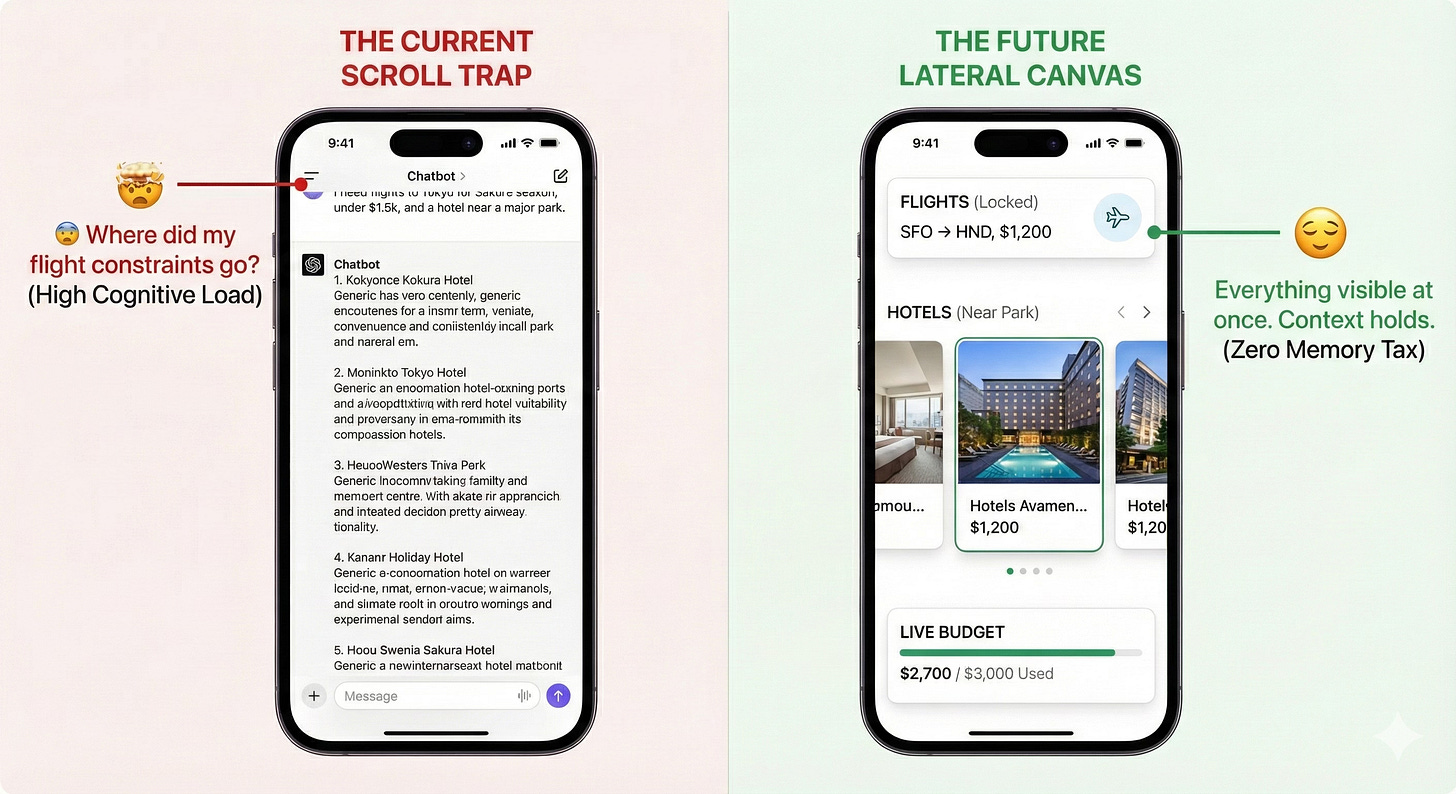

Why Travel AI needs a new UI

🗺️ Since mid-2024, travel AI faces challenges with chat-based UIs as users demand immersive experiences. Generic AI chatbots struggle with diverse travel needs, compelling users to visit over 240 pages for a booking decision. Structural issues include siloed data and misaligned business incentives. By 2025, AI enhanced operational efficiency in travel; however, the focus is shifting towards user experiences. 2026 is expected to prioritize immersive interfaces over smarter chatbots, adapting to traveler needs and enhancing engagement.

-

Travel Tech Essentialist #193: Direction

💻 U.S. Department of Transportation invests $1 billion to improve airports for families, including play areas and healthier food. Gina Acosta’s viral thread on flight-pricing AI prompts uncovered a $340 fare, usually $1,200. Bessemer Venture Partners identifies two AI startup types, “Supernovas” and “Shooting Stars,” with revenue benchmarks. Alphabet’s market cap rose $1.5 trillion in 2025, outperforming leading travel agencies. Over $500 million was funded for in-person connection initiatives, highlighting a trend back to offline experiences.

-

What was the impact of regulation on short-term rental markets in 2025?

🗺️ New York’s Local Law 18, effective from September 2023, restricts short-term rentals to under 30 days with an in-residence host. In 2025, average occupancy slightly increased to 25.34% from 2024’s 24.98%. Prices peaked at $696.40 in December 2024 but dropped 24.89% by 2025, averaging $442.87. In Amsterdam, regulations reduced annual whole-home rentals to 30 nights, with occupancy peaking at 60.33% in 2023, then declining.

-

Hospitalitynet’s Most Read Articles 2025

📚 Top 50 Most Read Articles on Hospitality Net over the past 12 months reveal crucial 2025 hospitality trends. AI advances, hotel marketing, and property management systems are key focuses. The European market saw €5.5 billion hotel transactions in Q1 2025, maintaining 2024 levels and surpassing the 2020-2024 average by 24%. The global wellness economy, at $6.3 trillion in 2023, is projected to hit $9 trillion by 2028, highlighting wellness as a core business strategy.

-

Hospitality.today™Top 50 of 2025

📅 2025 was significant for the hospitality industry with AI becoming integral in search, pricing, and customer service. Distribution evolved with APIs and AI-driven systems. Brands gained importance as independent hotels focused on pricing and loyalty. The guest journey became non-linear, highlighting the need for consistency across platforms. Simplicity emerged as a key advantage. Looking ahead, 2026 will focus on executing strategies in AI, distribution, and brand positioning.

-

The Hotel Media Review of 2025 – Zeitgeist of the Hotel Industry — Soler & Associates | Marketing Hotel Technology

🗺️ Booking.com retained its top position for the third consecutive year, driven by product expansion and dominance in demand control. Google’s AI advancements secured its second place, despite fears of traffic loss. Marriott, now third, climbed due to brand expansion and strategic partnerships. Airbnb’s slight rise is linked to product reinvention and lifestyle focus, though its strategy remains unclear. Expedia, fifth, concentrates on platform consolidation and B2B tech, focusing on optimization over innovation.

-

The Zeitgeist of Hospitality News 2025

📈 Hotel trends in 2025 show a heightened focus on real-time U.S. market performance, indicating industry vigilance. AI interest decreases but evolves, while guest experience and design remain constants. Acquisitions and consolidation dominate brand headlines. Booking.com maintains dominance, followed by Google. Marriott rises with strategic growth, and Airbnb experiments with diversification. OTAs like Expedia adapt to tech changes but trail behind. Notably, social media and reputation management declined in focus.

-

The 2025 Zeitgeist of the Hotel Industry

📈 AI, hotel trends, and guest experience topped the 2025 hotel zeitgeist. Market performance data, macro uncertainty, and AI integration into systems dominated discussions. Booking.com led for the third year, followed by Google, Marriott, Airbnb, and Expedia. Headlines focused on AI’s impact on search and planning, and the role of OTAs. Guest experience remained essential, while brand discussions centered on expansion and strategy. Notably, social media’s presence declined, indicating shifting industry priorities.