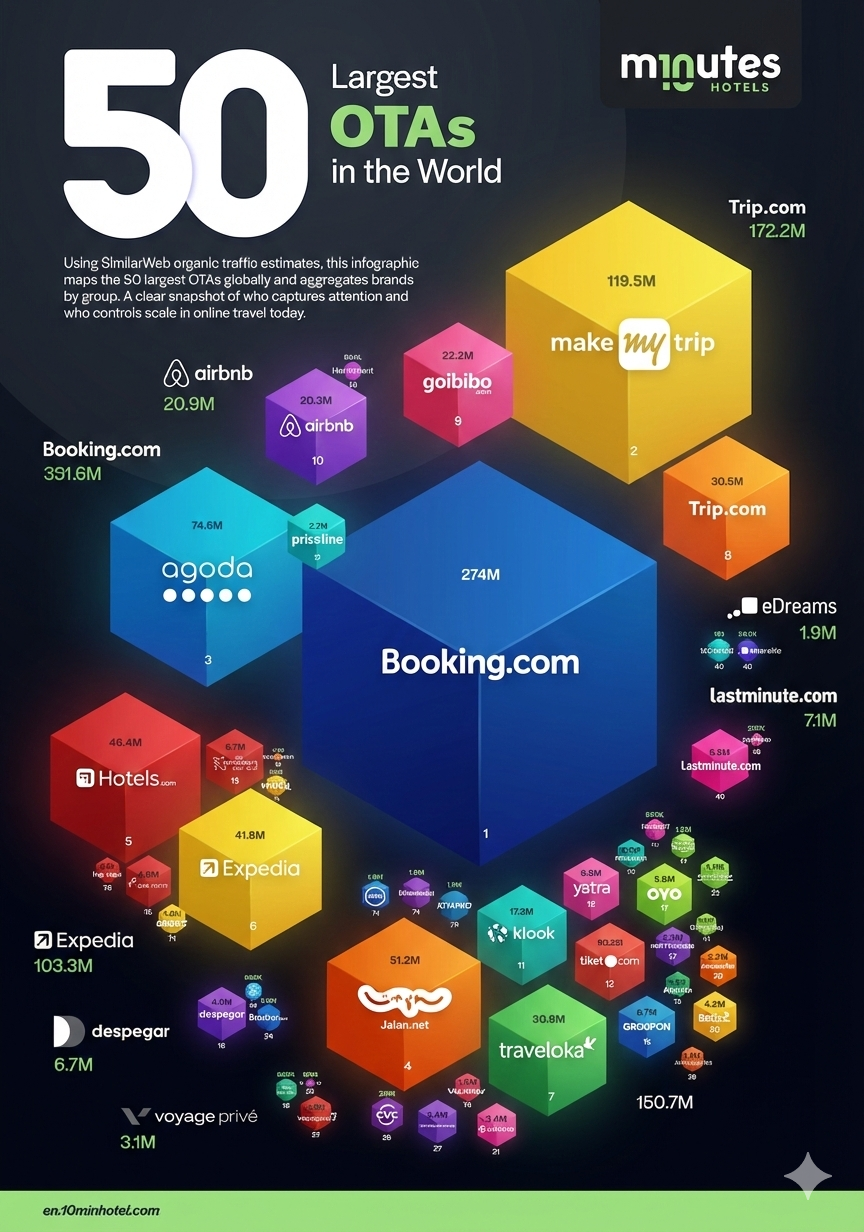

This page focuses on OTA news in the hotel industry. Online Travel Agencies such as Booking.com, Expedia, Agoda, MakeMyTrip, Trip.com and more play a central role in hotel distribution, pricing visibility, and guest demand worldwide. This page brings together curated news related to these OTAs from trusted and reputable sources, including leading industry publications, official company announcements, and expert analysis. By aggregating these perspectives in one place, it gives readers a clear and up to date view of how OTAs are evolving, from platform strategy and product innovation to partnerships, regulation, and the broader market trends shaping the hospitality ecosystem.

-

RateGain’s UNO Booking Engine Integrates Stripe to Strengthen Direct Booking Payments for Hotels Globally

💳 India, 20th March 2026: RateGain Travel Technologies integrates Stripe with its UNO platform to enhance cross-border payments in the hotel booking process. This integration targets seamless transactions for an international guest base, reducing drop-offs and improving conversion. RateGain, founded in 2004, serves over 13,000 customers across 160+ countries. UNO’s Direct Stack aims to support hotels globally by combining demand, booking, distribution, and payments on a single platform for effective competition and reduced intermediary reliance.

-

144 – The failure of full self-service

📈 Louis Vuitton launched a hotel in Bangkok as an immersive luxury brand experience. Amazon Go is closing more stores due to its lack of human interaction. High-end travel still relies on human relationships, despite AI’s rise. Airbnb’s revenue growth is driven by AI integration, not luck. Outdoor hospitality is booming, with glamping showing double-digit growth and Marriott entering the niche. Finally, subscription models in airlines, inspired by retail, offer flat-rate convenience and loyalty.

-

Shop Like a Traveller: A Practical Guide to Your Hotel’s Online Visibility

How can you ensure your hotel is visible when potential guests search online? Travellers have more information, more choices, and higher expectations than ever before. To really understand how they…

-

The 3 levels of pricing architecture: where is your profitability decided? (Part 2)

📈 Who? Hotels. When? Present and future. Where? Direct sales channels. What? Pricing architecture levels: Level 1 (Static), Level 2 (Granular), Level 3 (Autopilot). How? Adjusting pricing strategy by demand responsiveness. Hotels using Level 2 technology can dynamically adjust supplements, capturing higher margins and better conversion rates. Level 3 relies on exhaustive RMS mapping for optimal pricing. Result? Level 2 often offers a sweet spot, allowing competitive pricing against OTAs without breaking parity.

-

#ai #artificialintelligence #ainative #traveltech #extendedstay #proptech #hospitalitytech #otas #startup #futureoftravel #b2b #platformeconomy #dynamicpricing #dubaistartups #estaie | Nimit Solanki 🚀🦄 | 12 comments

🗺️ Sabre, PayPal, and Mindtrip announced their partnership to create an agentic AI travel booking system, where AI completes bookings autonomously. This system connects Sabre’s vast inventory of airlines and hotels, with PayPal for payments and Mindtrip for AI planning. This innovation allows booking through AI without multiple platforms, challenging Big Tech’s dominance in travel distribution. The AI can autonomously book and manage trips, prompting travel companies to rethink strategies for staying relevant.

-

The way travelers find and book trips is changing faster than most operators realize. And the companies that controlled travel distribution for 20 years are scrambling. Expedia dropped 6.7%… | Ari Adnan Cibari

🌎 Expedia’s stock fell 6.7%, Booking.com 17%, Airbnb 24%, and TripAdvisor trades at $9. AI agents, including OpenAI’s Operator, are transforming travel booking by negotiating reservations via chat. Apple’s Siri can book through Expedia without user interaction. OTAs might become obsolete as AI handles bookings. The EU regulates Google, but AI assistants like ChatGPT lack similar rules, risking exclusive deals with hotel chains. Operators must adapt for visibility in AI-driven travel searches.

-

RevPAR vs. NetRevPAR: Why Your Most Popular Metric is Misleading

This article was written by Demand Calendar. Click here to read the original article For decades, the hotel industry has treated RevPAR (Revenue Per Available Room) as the ultimate “North…

-

“AI Is Agenda Item 1, 2, 3, 4 and 5” for Hotel Leaders – Ryan Mann, McKinsey & Company

💻 Ryan Mann of McKinsey & Company spoke at ALIS in January 2026 about AI’s pivotal role in hospitality, emphasizing its transition from experimentation to executive priority. He highlighted three key areas: internal automation, operational efficiency, and search/booking disruption. The focus is on AI adoption challenges, data readiness, and trust. Leaders are encouraged to adopt scenario-based thinking as OTAs, suppliers, and systems vie for booking control. This episode outlines actions for navigating the evolving distribution landscape.

-

BookingsCloud launches Opportunity Score to show short-term rental operators exactly where booking demand is being missed

💰 New York, NY, 18 February 2026 – BookingsCloud launched Opportunity Score, a predictive metric for short-term rental operators. The score ranges from 0 to 100 and identifies listings worth marketing to optimize booking potential. It automatically activates marketing campaigns, reducing reliance on OTAs. Opportunity Score evaluates market-specific booking windows, availability, and revenue potential. Amber Knight emphasizes its ability to automate decision-making. Supported by Advance, BookingsCloud reports increasing direct bookings annually while OTA bookings decline.

-

#agenticai #traveltech #ai #customerexperience #innovation #digitaltransformation | Clément Guérin

🛩️ Sabre, PayPal, and Mindtrip announced plans for an end-to-end agentic AI travel experience, revolutionizing the industry with seamless, personalized planning. Travelers desire effortless journeys, not fragmented steps, expecting one intuitive flow from inspiration to payment. This shift requires travel organizations to enhance customer experiences, focusing on conversational, responsive service. The future of travel is digital, contextual, and intelligent, demanding adaptation to new traveler habits.

-

RateGain Highlights Findings from Sojern’s 2026 State of Destination Marketing Report: Measuring Economic Impact Ranks as DMOs’ Top Priority Amid AI Disruption

This article was written by Rategain. Click here to read the original article India, 18th February 2026: RateGain Travel Technologies Limited (NSE: RATEGAIN), a global leader in AI-powered SaaS solutions…

-

🏨 Is ChatGPT quietly becoming the new way to book hotels? In the past weeks, major hotel brands and travel platforms have launched their own apps inside ChatGPT. All of them let users search and… | Marcel-Felix Krause

🛖 Major hotel brands and travel platforms have integrated apps into ChatGPT, making hotel bookings possible directly through chat. Key players include Accor, Hyatt, Booking.com, Tripadvisor, and others. ChatGPT, with over 800 million weekly users, is transforming travel planning by allowing users to describe preferences in natural language and book seamlessly. Expedia mentions this as a comprehensive conversational journey from inspiration to booking. Early adopters in the hotel industry gain a significant advantage.

-

The AI Isn’t Making Things Up. It’s Reading Your OTA Description

📝 AI tools like ChatGPT and Gemini rely on OTA listings for hotel information. Outdated or generic descriptions on platforms like Booking.com or Expedia affect a property’s online reputation and booking potential. This week, property managers are advised to review their listings, correcting inaccuracies and vague descriptions. Inaccurate details lead to missed bookings, as AI uses these listings to provide answers to potential guests. Regular updates could take about 45 minutes across platforms.

-

7 Proven Strategies to Boost Direct Bookings and Outpace OTAs in 2026

This article was written by Trustyou. Click here to read the original article If you’ve been in hospitality for a while, you already know this: online travel agencies (OTAs) still…

-

One Inbox, Every Review: The Smarter Way Hotels Manage Guest Feedback at Scale

This article was written by Trustyou. Click here to read the original article Hotel teams know the feeling all too well: ten browser tabs open, each one pointing at a…

-

Hotel BI vs. Excel: The Hidden Costs

This article was written by Demand Calendar. Click here to read the original article Hidden Cost #1: The Manual Work BurdenIn most hotels, the “cost” of Excel isn’t found in…

-

Direct booking in 2026: Personalization, AI visibility and experience

💻 Feb 17, 2026: Hotels globally are focusing on AI-driven travel assistants to enhance booking, personalizing experiences to attract direct bookings. Despite the dominance of online travel agencies (OTAs) due to convenience and transparency, AI is reshaping booking behavior. Key strategies include capturing first-party data to build loyalty, offering value-added perks, and using intelligent booking assistants and guest reviews for better visibility and conversions. Early and post-stay engagement enhances repeat bookings and strengthens guest relationships.

-

The tourist tax debate returns: what it means for London hotels

🛒 London, 2026: A proposed 3% tourist tax could generate over £350m annually for the city, with Central London alone contributing £275m. Hoteliers fear this levy, amid 20% VAT and rising costs, threatens competitiveness. Westminster could raise £95m, while Camden, Kensington and Chelsea, and Tower Hamlets may exceed £20m each. Critics argue this tax, alongside high VAT, could make the UK less appealing to tourists, pushing the VAT rate to 27%. Industry seeks clarity on fund allocation.

-

AI and hotel metasearch: disruption or evolution?

🛫 Feb 16, 2026, AI-driven booking agents are transforming travel metasearch platforms like Google Hotels, Kayak, Skyscanner, and Trivago. AI assists in hotel price comparisons through APIs and personalizes recommendations, suggesting trips proactively. Despite potential, technical barriers like real-time pricing and complex infrastructure delay full automation. A hybrid model is emerging where AI coexists with traditional platforms. Future shifts include platform consolidation and a focus on storytelling by hotels to leverage AI’s inspiration-driven searches.

-

Are OTAs actually at risk from AI? Over the past couple of weeks, OTAs, including Airbnb, have taken a noticeable hit to valuations as investors wrestle with a big question: If AI changes how… | Jamie Lane | 14 comments

💸 Airbnb, Expedia, and Booking.com face potential AI disruption in travel planning. Investors question if AI will reduce these OTAs’ relevance. On Airbnb’s earnings call, Brian Chesky highlighted Airbnb’s robust infrastructure: an 18-year host platform, complex customer service, a vast payment system, 200 million verified identities, and proprietary data. Airbnb aims for an AI-native product enhancing trip planning. The debate centers on whether AI will mainly affect discovery or also impact booking processes.

-

Hilton and Marriott International just added AI to their risk factors in regulatory filings this week. The two largest hotel companies in the world are formally warning investors that AI could erode… | eric lutz 🫒 | 28 comments

💻 Hilton and Marriott International, the largest hotel companies globally, have incorporated AI as a risk factor in their regulatory filings this week. They warn that AI might erode brand loyalty, shift bookings from direct channels, and increase distribution costs. AI could revolutionize hotel bookings by surpassing loyalty programs and offering personalized experiences, potentially diminishing brand value. The future success of hotels will depend on direct guest relationships, independent commerce, and unique experiences that AI cannot replicate.

-

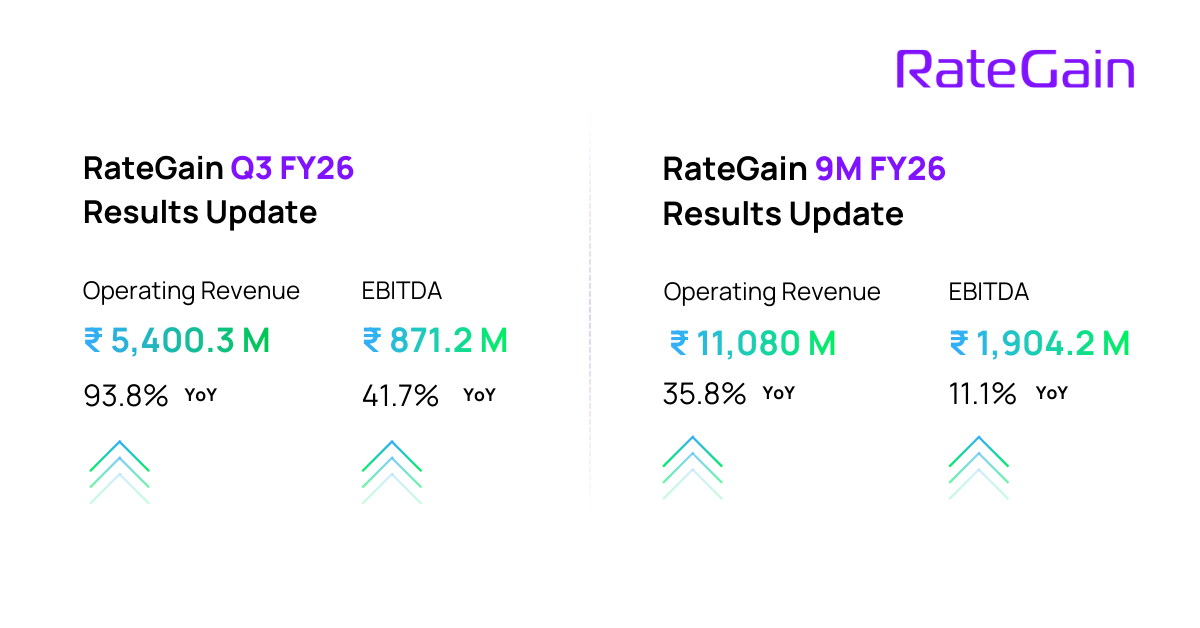

RateGain reports 94% YoY revenue growth in Q3 FY26; 42% increase in EBITDA; expands AI capabilities with Sojern integration on track

📈 New Delhi, 13th February 2026: RateGain Travel Technologies reported a 93.8% YoY revenue increase in Q3FY2026, hitting INR 5,400.3 Mn. The company’s EBITDA margin stood at 16.1%, while PAT reached INR 264.5 Mn. Following Sojern’s acquisition in November 2025, RateGain repaid 20.2% of its acquisition debt. A global team of 1,250+ supports operations. Recognized by ET Corporate Excellence Awards, RateGain was named Emerging Company of the Year.

-

The Trust Dividend: Strengthening Hospitality’s Digital Integrity in 2026

📡 As of 2026, the hospitality sector faces a $1.3 trillion threat from travel fraud. Sophisticated scams, like AI-generated fake hotel sites, and tactics like “ClickFix” compromise hotel extranet credentials. New FTC rules penalize AI-generated reviews with fines up to $51,744. PCI DSS 4.0 mandates Multi-Factor Authentication for guest data access. Hotels combat fraud by using branded apps, active brand monitoring, and staff training to protect against these evolving digital threats.

-

Talent, Technology and Tenacity: The State of India’s Accommodation Industry in 2025

📈 Indian accommodation sector thrived in 2025, with 75% of hoteliers optimistic about growth. 70% reported higher occupancy rates, while AI adoption and upskilling are priorities. Hoteliers plan to hire 9.9 employees on average, focusing on housekeeping and food roles. Investment intentions dipped slightly, with 14% scaling back. Digital platforms are vital in mitigating seasonality, with 79% finding them effective. The survey by Statista and Booking.com involved 250 executives, conducted between July 7 and September 1, 2025.

-

Understanding Distribution in Hospitality: Why It Shouldn’t Be a Black Box

📰 In the hospitality industry, distribution is key. Despite its complexities, the process is straightforward: rooms, rates, and availability reach customers effectively. As of 2026, technology advancements have led to a fragmented ecosystem, emphasizing the need for a foundational understanding of distribution systems like PMS, RMS, and CRS. Knowledge retention is crucial, especially as experienced professionals exit the workforce. To demystify distribution, understanding what is sold, where, and how it’s represented is essential.