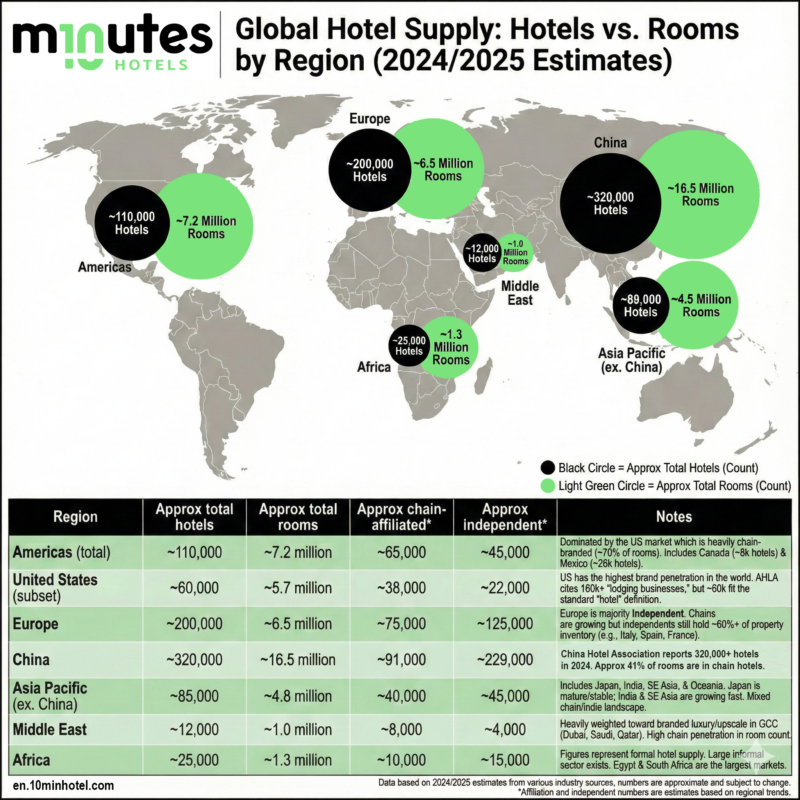

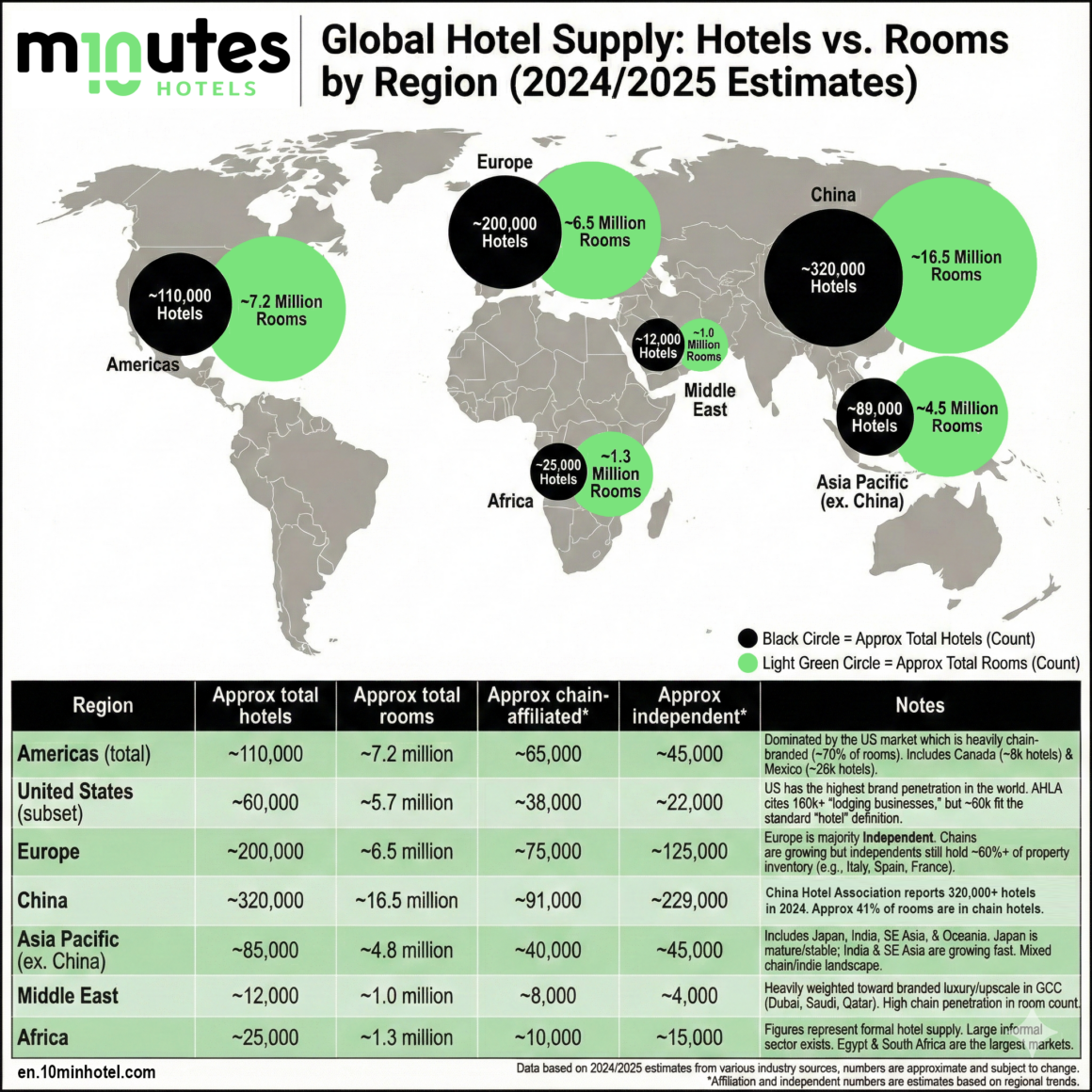

Globally the hotel supply falls into two broad patterns. The Americas count about 110,000 hotels and 7.2 million rooms. The United States alone has roughly 60,000 hotels and 5.7 million rooms and remains one of the most chain dominated markets in the world. Data from the American Hotel and Lodging Association confirms that about seventy percent of US rooms belong to branded chains. More from AHLA.

Europe stands at the opposite end of the spectrum. With about 200,000 hotels and 6.5 million rooms, most of its supply remains independent. The European Commission’s tourism statistics confirm that a large majority of European hotels fall under the “independent” category. More on Eurostat.

China is the world’s largest market by volume, with around 320,000 hotels and about 16.5 million rooms. While about forty percent of its rooms are in chains, the property count shows a much larger independent base. More on Gov.cn

Across Asia Pacific outside China, the landscape varies widely. Japan maintains a strong independent base with thousands of small or traditional inns. Southeast Asia blends branded city hotels with independent resorts. Market snapshots for these regions are available in the HVS Asia Pacific report.

Two regions stand out for future growth. Asia Pacific continues expanding rapidly, especially in Southeast Asia and India, where demand and development pipelines remain strong. In the Middle East, the hotel industry is entering its largest ever development cycle. Construction pipelines now exceed 160,000 rooms. Saudi Arabia, the UAE, and Egypt lead this wave, driven by state backed tourism strategies and giga projects. Lodging Econometrics reports record development pipelines for the region at https://lodgingeconometrics.com. Additional performance data for the Middle East is monitored by STR Global at https://str.com and detailed market forward views are available through Knight Frank at https://www.knightfrank.com.

Across all regions the divide between chain and independent supply has strategic implications. Independent hotels face rising operational and compliance costs. Chain affiliated properties benefit from distribution scale and brand systems. This is driving more conversions and the growth of soft brands and collections. European consolidation pressures are documented by Statista and supported by European Commission data. Asia Pacific brand expansion and recovery trends are covered in detail by HVS Global. US conversion trends and franchise growth are outlined in AHLA reports. Global hotel performance indicators are available through the JLL Hotels and Hospitality research platform at https://www.jll.com.

Despite the structural differences, most research forecasts steady global hospitality growth. The global hotel market is expected to grow at a compound annual growth rate close to five percent toward 2030. HotelTechReport provides accessible industry trend summaries at https://hoteltechreport.com and broad industry data sets are compiled at https://www.hotelnewsresource.com.

The global hotel industry is moving into its next cycle with three clear patterns. Mature branded markets like the United States continue relying on conversions. Europe remains the defender of independent hotels but faces ongoing consolidation. High growth regions such as the Middle East and Asia Pacific are adding supply at unprecedented levels and are shaping the next generation of global hotel brands.

Research notes and global property and room counts referenced in this article are based on 2024 and 2025 estimates compiled by 10 Minutes Hotels using multiple AI platforms to cross check the figures. The infographic was also partly made by AI and reviewed by hand, AI watermarks have been left for transparency.