Welcome to our Revenue Management feed. Here you’ll find the most interesting revenue management articles we’ve aggregated from around the world, all in one place. Posts are sorted with the latest at the top, so you can quickly stay up to date with what matters most.

Implementing Demand Calendar BI Tool Enhances Hotel Group Forecasting Accuracy for Strategic Growth

📈 CEOs of hotel groups prioritize forecasting to meet financial goals and manage risks. Accurate forecasts allow strategic decisions on capital expenditure and operational alignment. Implementing a unified forecasting system gives early warnings and ensures portfolio-wide alignment. Weekly updates and a centralized Business Intelligence tool, like Demand Calendar, enhance transparency and predictability. This approach ensures scalability and seamless integration of new acquisitions, supporting proactive management and future growth.

Share

U.K. hotel sector rallies in second half of 2025: Knight Frank

🏨 The U.K. hotel sector in 2025 showed resilience, with a strong recovery in the second half after a challenging start. London saw an 82.5% occupancy rate, up by 1.2 percentage points. ADR declined by 2.5% in H1 but grew by 2% in H2. RevPAR growth was 1.9% in London and 1.8% in regional markets for 2026. Regional occupancy reached 79%, and leisure revenues rose 6%. Payroll costs increased by 30% per available room compared to 2019.

Share

2025 cannot be read as a linear trajectory

🌍 January: Southern and Eastern Europe led with strong RevPAR growth, driven by luxury segments. February: Central Europe and Alpine areas outperformed amid price sensitivity in Southern Europe. March: Budget segments declined, while the luxury market remained resilient, especially in Eastern Europe. April: Leisure destinations saw volume-driven RevPAR increases, though pricing stayed cautious. May: Secondary markets showed robust growth, challenging traditional leaders. June: Anticipated high season exposed pricing fatigue, highlighting market variability.

Share

2025 in the European Union: a turning point rather than a growth year

🗺 Europe, 2025: Hotel RevPAR rises by +1.7%, driven by a +0.9 percentage point increase in occupancy. Southern Europe, particularly Spain and Italy, bolstered growth, with Malta and Baltic states showing sharp gains. Germany underperformed following a strong 2024. Despite international demand boosting the market, domestic demand remains weak, impacting budget segments. By year's end, Europe enters 2026 with occupancy growth signaling potential for hoteliers.

Share

Wyndham Hotels & Resorts Reports Q4 and Full-Year 2025 Results

📈 Parsippany, New Jersey—In 2025, Wyndham Hotels & Resorts reported a 4% system-wide room growth and a record 870 development contracts (up 18% year-over-year). Their development pipeline hit 259,000 rooms. Full-year diluted EPS fell 31% to $2.50; adjusted EPS rose 6% to $4.58. Net income dropped 33% to $193 million, though adjusted net income increased 2% to $353 million. Adjusted EBITDA grew 3% to $718 million. The board approved a 5% increase in the quarterly dividend to $0.43 per share for 2026.

Share

RevPAR vs. NetRevPAR: Why Your Most Popular Metric is Misleading

💸 In the hotel industry, RevPAR has long been the key performance metric, but it overlooks the cost of acquiring guests. Case in point: A $200 Booking.com reservation nets $160 after commissions, while a $180 direct booking nets $176, being 10% more profitable. NetRevPAR, which factors in Customer Acquisition Costs, offers a clearer profitability perspective. Automated tools like Demand Calendar streamline this analysis, helping hotels shift from volume-focused to profit-driven strategies.

Share

Strategic Revenue Management Solutions: A System-Driven Approach for Independent Hotels

💸 Independent hotels in the U.S. need structured revenue management for sustainable performance. RevOptimum has launched Strategic Revenue Management Solutions, offering a hands-on model to align pricing, demand signals, and channel strategy with measurable outcomes. This model, designed for independent hotels, boutique operators, and management companies, includes revenue diagnosis, strategic alignment, and ongoing optimization. It extends hotel leadership by providing structured execution. Explore more at RevOptimum's website for proactive revenue leadership.

Share

OTA Independence & Direct Revenue Strategy: A Smarter Path to Sustainable Hotel Profitability

💸 Independent and boutique hotels face challenges from online travel agencies (OTAs) pressuring profitability. To address this, RevOptimum has launched the "OTA Independence & Direct Revenue Strategy." This program helps hotels regain control over pricing and guest acquisition, focusing on revenue sustainability. It evaluates OTA exposure, pricing alignment, and direct booking performance. Targeted at independent hotel owners and operators, this strategy is crucial as acquisition costs rise and competition grows. Learn more at RevOptimum's website.

Share

IHG Reports Full-Year 2025 Results

💵 IHG Hotels & Resorts reported its 2025 financial results. Who? IHG. When? 2025. Where? Global. What? RevPAR up 1.5%, global revenue $35.2B, net system growth 4.7%, opened 65,100 rooms. How? Fee margin rose to 64.8%, operating profit $1.26M, adjusted EPS up 16%. Cash flow: $898M, net debt increase $551M. Shareholder returns: $900M buyback, $270M dividends, new $950M buyback. Launched a new brand, Noted Collection, expanding in the premium segment.

Share

IHG Reports Full-Year 2025 Results

📈 IHG Hotels & Resorts reported its 2025 results with key highlights: Global RevPAR up 1.5%; total revenue at $35.2 billion, up 5%. They opened a record 443 hotels, adding 65,100 rooms. Shareholder returns included $900 million in buybacks and $270 million in dividends. Net debt increased by $551 million. A new $950 million buyback program is expected to return $1.2+ billion in 2026. A new brand, Noted Collection, launched as part of their expansion strategy.

Share

Hotel Revenue Growth Audit: A Strategic Path to Stronger Market Share and Direct Revenue

💸 Independent and boutique hotels face rising distribution costs and competition pressures, often operating below potential. RevOptimum's Hotel Revenue Growth Audit uncovers hidden revenue opportunities through analyzing market share, pricing, segment mix, and direct booking capture. Designed for hotel owners, operators, and management companies, this audit provides strategic insights to boost profitability. As competition grows, identifying performance gaps helps protect value. Request the audit for improved hotel performance. [RevOptimum](https://www.revoptimum.com/hotel-revenue-growth-audit) specializes in revenue diagnostics across the U.S.

Share

Hyatt Reports Q4 and Full-Year 2025 Results

📈 Hyatt Hotels Corporation reported a 4.0% RevPAR growth in Q4 and 2.9% for 2025. Their net income for 2025 was a $52 million loss, with an adjusted net income of $209 million. Gross fees reached $1,198 million for 2025, up 9.0%. Total debt was $4.3 billion, with $2.3 billion in liquidity. They closed $140 million in property sales and announced a $0.15 dividend per share for Q1 2026, payable March 12.

Share

Why revenue management isn’t enough for complex portfolios | Duetto

📈 Mid-size hotel chains face challenges as property-level revenue management struggles at scale, causing pricing drifts and revenue silos. Duetto's Revenue & Profit Operating System (RP-OS) offers a unified approach, boosting RevPAR by 28% for RIMC Hotels. This system streamlines pricing, forecasting, and decisions, reducing manual effort and enabling earlier interventions, thus enhancing portfolio performance without adding complexity.

Share

Marriott International Q4 U.S. RevPAR dragged down by government shutdown, but up globally

🚨 A 43-day government shutdown pulled Marriott International's U.S. and Canada RevPAR into negative territory in Q4 2025. However, RevPAR increased globally by 2%, with international markets seeing a 6.1% surge. Q4 net income reached $445M, while adjusted net income was $695M. Marriott added 73,600 rooms, achieving a 4.3% net room growth, totaling 9,800 properties by year-end. In 2026, Marriott projects 1.5-2.5% RevPAR growth and plans to return over $4.3B to shareholders.

Share

The Myth of “Full = Profitable” in Hotels

📈 Higher occupancy and revenue growth in hotels might not translate to increased profitability due to rising costs and distribution fees. Traditional metrics like occupancy and RevPAR fall short, urging a shift to profit-first strategies such as margin protection and value-aware leadership. For example, a hotel with 85% occupancy and a 210€ ADR can achieve 140€ profit per room, outperforming a 95% occupancy at 180€ ADR which results in 110€ profit per room, potentially adding over 75,000€ annually.

Share

Outdoor accommodation platform Pitchup.com…

🏖 Pitchup.com, a leading online booking platform, surpassed £500 million in global bookings as of 2026, ranking 36th globally and 6th in Europe for OTAs. Valentine's weekend bookings rose 25% year-on-year. In January, South West England was the most affordable region at £57.14 per night. European demand surged with Portugal up 134% and Hungary and Germany up 70%. Shorter stays with a 4% decrease in duration and 5% decline in booking lead times highlight changing travel trends.

Share

#hotelfinance #hotelmanagement #hotelops #hotelinvestment #revenuemanagement #adr #revpar | Jinheon KIM

💸 RevPAR, a key hotel metric, can mislead when used in isolation. Higher RevPAR may coincide with stagnant profits due to rising costs or discounting strategies. Operational stress, such as overtime and service delays, isn't reflected in RevPAR. Short-term discounts boost RevPAR but can harm long-term pricing. Owners focus on metrics like GOP and NOI instead. RevPAR indicates performance, but true success is seen in flow-through, cost discipline, and sustainability.

Share

RMS Pay surpasses €1 billion in transactions as operators embrace fully integrated payments

💳 RMS; one year post-launch; global. RMS Pay processes over €1 billion in transactions. Operators see faster cash flow, 99.95% dispute-free rate, saving 10+ hours weekly. Roomzzz Aparthotels benefits from automation. RMS Pay, integrated into RMS, allows quick payment setup, supporting digital wallets and Buy Now, Pay Later. Popular features include Pay by Link and Charge to Room. PCI DSS-certified with fraud monitoring. RMS serves 7,000+ businesses in 70 countries.

Share

I honestly don’t understand how multi-day tours are expected to work on GetYourGuide … GetYourGuide launched multi-day tour sales with a lot of noise and publicity, but in reality these products… | Andrey Matveev | 13 comments

📈 GetYourGuide's launch of multi-day tour sales faces challenges. Operators struggle with selling high-priced tours (€2,000–€7,000) due to a 30% commission, akin to cheaper activities (€50–€100). Standard 24-hour cancellation policies threaten profitability, potentially leading to significant losses from prepaid expenses like hotels and logistics. One operator paused a 5-day Italy tour. The industry is queried about successfully negotiating better terms for multi-day offerings. Are others facing similar challenges?

Share

Canadian Lodging Outlook Quarterly 2025-Q4

🏨 Amid global uncertainty, Canadian hotels achieved 66% occupancy with nearly 70 million rooms filled. Average daily rates rose by 3.5%, boosting RevPAR by 4.2%. The luxury segment excelled with an 8.7% RevPAR increase. HVS and CoStar's report covers six major markets. For comprehensive data, subscribe to the Canadian Hotel Review. Reach out to CoStar at +1 (800) 613-1303. HVS, established in 1980, offers 4,500+ yearly assignments worldwide.

Share

Breaking revenue silos in growing hotel chains

💸 Medium-sized hotel chains face revenue silos due to disjointed tools and manual workarounds, creating inconsistencies and eroding confidence. Cluster Revenue Managers handle 5-10 properties without increased staff, making alignment crucial. A unified strategy with shared metrics, demand signals, and market context enhances decision-making. Duetto's platform supports multi-property coordination, reducing manual consolidation. The transition to shared outcomes fosters faster decisions, proactive planning, and sustainable growth.

Share

Accrual Accounting for Hotels: How Fairmas Improves Financial Performance

📈 Fairmas, established in 2003, aids over 5,500 hotels globally with accrual accounting through software for financial planning and analysis. Accrual accounting captures revenues and expenses when incurred, not paid, providing a truer performance view. Challenges include managing multiple departments, delayed invoices, and manual adjustments. Fairmas simplifies accrual management, supports precise profit-and-loss analysis, and enhances decision-making through integrated financial insights, ensuring reliable, transparent reporting across hotel portfolios.

Share

Hotel Revenue Leakage: 9 Silent Profit Leaks (and How to Find Yours Fast)

📈 Hoteliers are losing around 6% of revenue due to rate leakage, with OTA commissions between 15–25% worsening margins. The Hotel Revenue Leak Diagnostic identifies and quantifies revenue leaks caused by misaligned pricing, reliance on high-cost channels, missed demand signals, and poor operational practices. The tool provides insights into channel and pricing imbalances and potential financial impacts. It's ideal for independent hotels and operators seeking clarity on revenue issues before further investments.

Share

December 2025: European hotels deliver a final sparkle ahead of 2026

📍 In December, European hotels saw a RevPAR increase of +6.1% to €80.2, with occupancy rising by +2.2 percentage points to 63.7% and average rates increasing by +2.4% to €125.8. The Spain–France–Italy trio and the Alpine arc drove this growth, while corporate markets like Germany and parts of Benelux showed mixed results. December acted as a year-end boost for hoteliers, benefiting from high-demand periods and premium customers.

Share

Corporate travel costs diverge in 2025

🛬 Jan 26, 2026, U.S.: Hotel rates soared 20.5% to $229, spurred by operating costs and upgrades, while airfares fell 6% to $836, and car rentals dropped 4% to $75. Rail fares increased 7% to $255. Based on 700,000 bookings, corporate travelers favored 2.5-day trips and midscale hotels near business hubs. Secondary cities like Green Bay and Fresno saw increased demand, indicating a shift toward efficient, value-driven travel strategies.

Share

Hotels.com Get a Room 2026 Forecast: Searches Skyrocket 445% for Summer’s Total Solar Eclipse

🗺️ Pro Football’s finale in Santa Clara, February 8, 2026, shows a 395% YoY search increase, with average hotel rates at $415/night. Winter Sports' event in Northern Italy (February 6-22) sees Milan searches up by 135% and Cortina d’Ampezzo by 280%. Route 66’s centennial in May drives demand, with Chicago up 30% and San Bernardino 50%. A global soccer tournament in June sees Los Angeles hotel demand rise 205%, prices at $805/night.

Share

Booking experiences online significantly…

📈 Hotels utilizing Journey's strategy from the "Stay for the Story" white paper saw up to 95% increased spend when offering bookable experiences like spa treatments and dining. On average, adding extras at booking boosts revenue by 16%. Establishments featuring spa services saw a 44% increase in spend, and advertising returns improved from 13 to 30. CEO Simon Bullingham emphasizes managing experiences to optimize growth, addressing rising costs and reducing OTA reliance.

Share

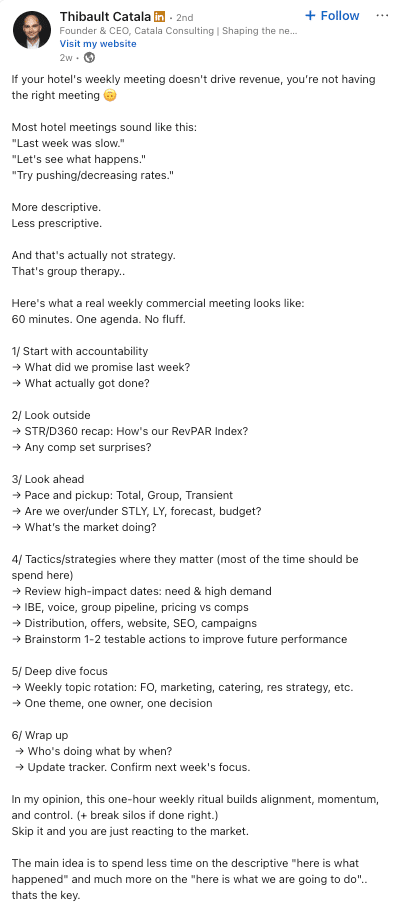

Pace vs. Pick-up: The Truth Behind the Numbers

📊 Pick-up, the "Movement," tracks recent booking activity, while Pace, the "Comparison," measures current status against benchmarks like Same Time Last Year (STLY). Both metrics are crucial for strategic planning. Volume Pace assesses room nights, and Rate Pace examines average daily rates (ADR). High Volume/Low Rate implies high operational costs, while Low Volume/High Rate suggests exclusivity. To optimize revenue, balance distribution channels and feeder markets, ensuring a strategic mix of group and transient business.

Share

U.S. hotel results for week ending 10 January

📈 U.S. hotel industry, 4-10 January 2026, saw year-over-year declines. Occupancy fell to 48.1% (-2.4%), ADR to $142.85 (-0.9%), and RevPAR to $68.69 (-3.3%). Tampa had sharp declines: occupancy 60.9% (-23.2%), ADR $156.81 (-12.0%), RevPAR $95.44 (-32.4%). San Diego's ADR dropped to $161.76 (-9.5%), RevPAR to $82.72 (-22.5%). St. Louis improved with occupancy 46.9% (+18.1%), ADR $117.19 (+14.2%), RevPAR $54.92 (+34.9%), aided by the U.S. Figure Skating Championships.

Share

Profitability Data Shows That Rethinking Traditional Revenue Management Is Now Critical For Hotels

📈 In 2025, global RevPAR grew by 19% since 2019, but booking costs rose by 25%. The Americas had an average flow-through of 18%, while Europe was at 29%. Duetto and HotStats, through their Revenue & Profit Operating System, reported a 6.8% increase in GOPPAR, with a 2.1 percentage point improvement compared to industry averages. The RP-OS led to an average 4 percentage point improvement post-implementation. A summit on profit and revenue management is scheduled for April 16, 2026, in Florida.

Share